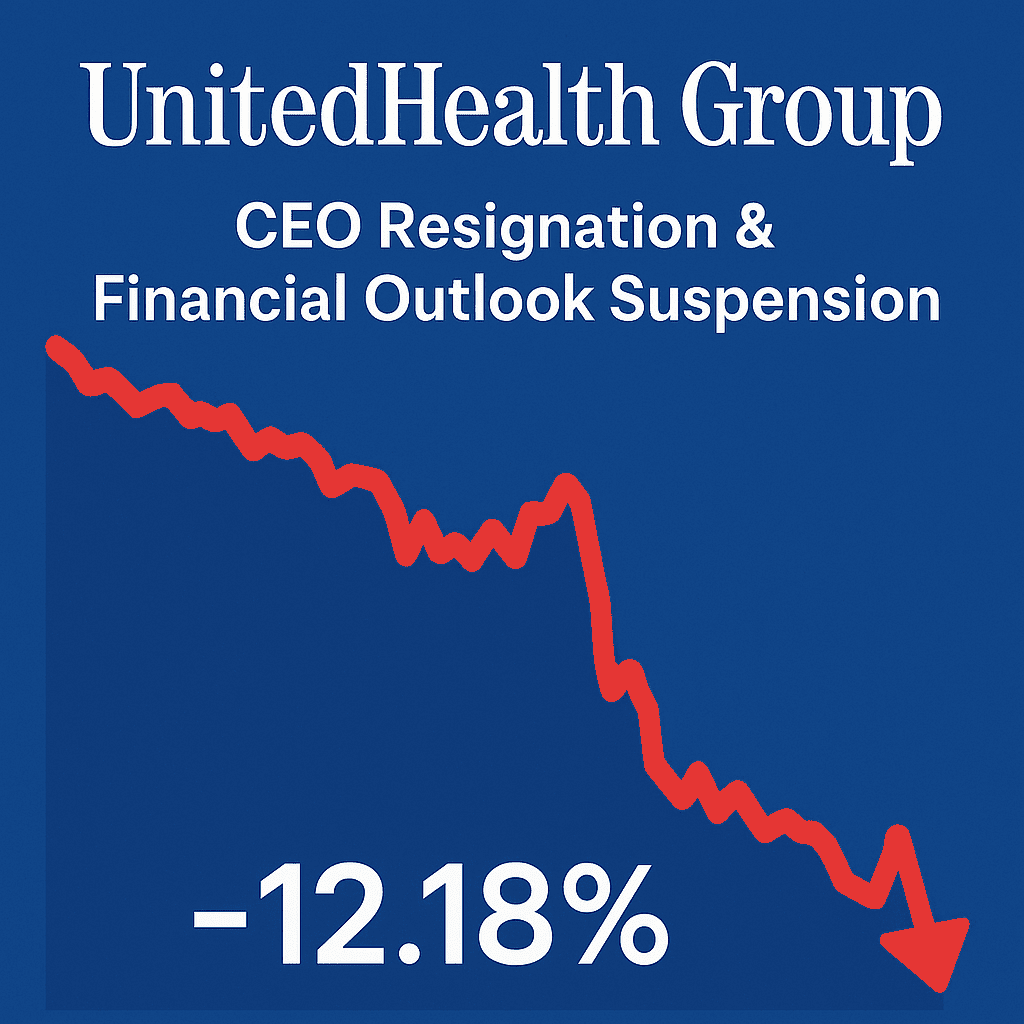

UnitedHealth Group (UNH) Stock Takes a Major Hit After CEO Departure and Financial Outlook Suspension

UnitedHealth Group Inc. (UNH), one of the largest healthcare companies in the United States, has recently been in the news due to significant developments affecting its stock price. The company experienced a notable drop in stock value, which raised concerns among investors. This post will delve into the reasons behind this sharp decline, the resignation of CEO Andrew Witty, the suspension of its 2025 financial outlook, and what this means for the future of the company and its shareholders.

The Unexpected CEO Resignation

One of the main reasons behind UnitedHealth Group’s recent stock downturn is the sudden resignation of its CEO, Andrew Witty. Witty, who had been at the helm of the company since 2021, stepped down unexpectedly for personal reasons. This left many investors and analysts shocked, as Witty had been seen as a key figure driving the company’s growth and strategic direction.

In light of Witty’s resignation, the company quickly appointed Stephen Hemsley, former CEO and current chairman of the board, as the interim CEO. Hemsley’s leadership in the past is seen as a stabilizing force, but the abrupt leadership change often raises concerns about potential disruptions within a company.

The CEO resignation came at a time when UnitedHealth was navigating through various challenges, including increasing healthcare activity and rising medical costs. A leadership transition in such turbulent times creates uncertainties, which can lead to negative market reactions. For investors, this news has led to questions about the company’s future direction and whether it will be able to maintain its competitive position in the healthcare market.

Suspension of the 2025 Financial Outlook

In addition to the CEO change, UnitedHealth Group also made the decision to suspend its 2025 financial outlook. The company cited higher-than-expected medical costs, especially within its Medicare Advantage plans, as the key reason for this suspension.

The company reported that it had underestimated the rising healthcare costs, particularly for its new Medicare Advantage members. These unexpected costs have led to a deterioration in financial projections for the upcoming years, compelling the company to retract its 2025 guidance.

The suspension of the financial outlook has left investors in a state of uncertainty. UnitedHealth’s stock, which had previously been seen as a reliable performer, is now facing scrutiny. Investors often rely on financial guidance to gauge a company’s health and its future trajectory. With the suspension, many are left questioning whether UnitedHealth can weather these rising costs and return to stable growth.

Impact on Stock Price and Market Reaction

The market has responded strongly to these developments. Following the announcement of Witty’s resignation and the suspension of the financial outlook, shares of UnitedHealth Group experienced a sharp decline. The stock price dropped by nearly 13% in a single day, marking its lowest level since early 2021. This significant decline is a clear reflection of the market’s uncertainty about the company’s future performance.

While UnitedHealth remains one of the most dominant players in the healthcare sector, its stock is now facing increased volatility. The company has already warned that it will take time to recover from these setbacks, and investors are understandably concerned about its ability to bounce back quickly.

What’s Next for UnitedHealth Group?

Despite the current challenges, UnitedHealth remains a leader in the healthcare industry. Its vast portfolio of services, including its managed healthcare plans and its Optum division, which focuses on technology-driven healthcare solutions, positions the company to adapt to changing market conditions.

However, the resignation of CEO Andrew Witty and the suspension of financial guidance have left a gap in leadership that will need to be addressed. Stephen Hemsley, as interim CEO, has a wealth of experience leading the company in the past, but the market will be watching closely to see how well he can steer the company through these turbulent times.

UnitedHealth’s ability to manage its rising medical costs will be crucial in determining its future. If the company can find ways to bring its expenses under control, particularly within its Medicare Advantage plans, it could stabilize its financial outlook. The company has also been investing heavily in technology and digital health initiatives, which could help offset some of the challenges it’s facing in traditional healthcare services.

What Should Investors Do?

For investors, the recent developments with UnitedHealth Group have raised important questions about the company’s future. Here are a few key takeaways:

- Monitor Leadership Changes: With the departure of CEO Andrew Witty and the appointment of an interim CEO, investors should keep an eye on any further leadership changes or updates from the company. Leadership transitions can bring both opportunities and risks.

- Evaluate Financial Health: UnitedHealth Group’s financial stability will be closely tied to its ability to manage healthcare costs. It’s essential for investors to track the company’s progress in addressing rising medical expenses and adjusting its financial forecasts.

- Long-Term Perspective: Despite the recent setbacks, UnitedHealth is still one of the largest and most influential players in the healthcare market. Investors with a long-term outlook may want to consider holding their shares through this volatile period, as the company’s vast resources and market position may allow it to recover over time.

- Diversification: As with any investment, diversification is key. UnitedHealth’s recent stock drop is a reminder of the inherent risks in the stock market. Investors should ensure that their portfolios are diversified to reduce risk and mitigate potential losses.

Conclusion

UnitedHealth Group’s recent challenges have put a spotlight on the risks inherent in the healthcare industry. The resignation of CEO Andrew Witty and the suspension of its 2025 financial outlook have sent shockwaves through the market, causing the company’s stock to fall sharply. While these developments have caused concern among investors, UnitedHealth’s strong market position and its continued investment in healthcare innovation provide a foundation for potential recovery.

For investors, the key will be to stay informed and make decisions based on both short-term market fluctuations and long-term growth potential. As always, careful monitoring of the company’s financial health and leadership will be crucial in determining its future trajectory.

Call to Action:

If you’re an investor or healthcare industry enthusiast, stay updated on UnitedHealth Group’s progress by subscribing to our newsletter. We provide the latest financial insights and updates on key market developments.

Also Read: –

New Honda Dio 2025 – A Smart Choice for Urban Riders

New Samsung Galaxy S25 Edge: A Powerful Flagship Packed with Impressive Features and Premium Design

Pingback: NVIDIA Llama Nemotron: The Future of Open Reasoning AI - India PrimeTime

https://t.me/s/Top_BestCasino/133