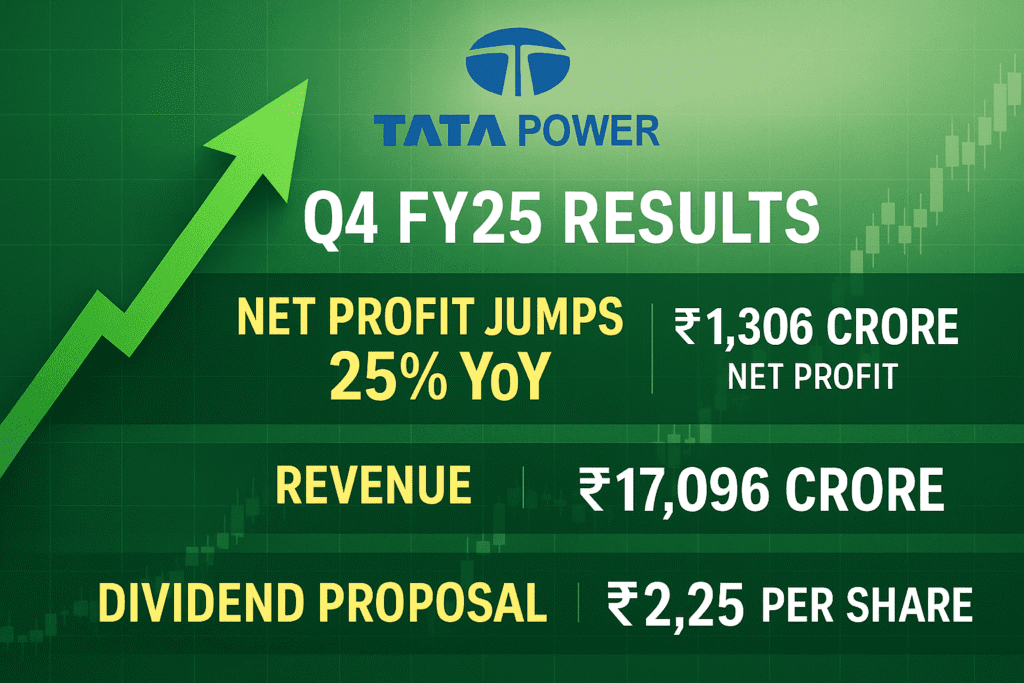

Tata Power Q4 FY25 Results: Net Profit Jumps 25% YoY – A Deep Dive into Growth, Green Energy, and Future Plans

Tata Power, one of India’s largest integrated power companies, has once again shown why it’s a leader in the energy sector. In Tata Power Q4 FY25 Results earnings report, Tata Power posted a 25% year-on-year (YoY) increase in consolidated net profit, sending a strong signal of resilience, strategic growth, and operational excellence.

In this detailed post, we break down the financial performance, key business segments, growth drivers, and future outlook of Tata Power — giving investors, analysts, and energy enthusiasts a complete understanding of the company’s current position and future direction.

📊 Q4 FY25 Financial Highlights

Tata Power’s consolidated net profit stood at ₹1,306 crore, compared to ₹1,046 crore in Q4 FY24 — a sharp 25% increase YoY. The growth was driven by strong performance across its generation, transmission & distribution, and renewable segments.

| Metric | Q4 FY25 | Q4 FY24 | YoY Growth |

|---|---|---|---|

| Revenue from Operations | ₹17,096 crore | ₹15,847 crore | 8% |

| Consolidated Net Profit | ₹1,306 crore | ₹1,046 crore | 25% |

| Proposed Final Dividend | ₹2.25/share | ₹2.00/share | 12.5% |

💡 The company also declared a final dividend of ₹2.25 per share, to be approved in the AGM scheduled for July 4, 2025, with the record date set as June 20, 2025.

🔋 Strong Performance Across Segments

Tata Power’s diverse business portfolio was a key factor behind its excellent quarterly performance. Here’s how the main segments performed:

✅ Generation and Distribution

- The traditional thermal power segment maintained stable output.

- Distribution business in Mumbai and Delhi continued to perform reliably with better operational efficiencies and demand management.

✅ Renewable Energy

Tata Power’s renewable vertical was one of the major highlights:

- Total renewable capacity: 4.5 GW operational

- Additional 5.5 GW under implementation

- Goal: 10 GW+ green portfolio in the near future

The company aims to achieve 70% capacity from non-fossil fuel sources by 2030, aligning with India’s clean energy transition goals.

☀️ Rooftop Solar & PM Surya Ghar Yojana Boost

Tata Power is aggressively expanding its rooftop solar business, now boasting a portfolio of over 2 GW. The company is strategically placed to capitalize on the PM Surya Ghar Yojana, which aims to provide rooftop solar power to one crore households.

This initiative presents a huge growth opportunity, especially for companies like Tata Power that have already built significant capabilities in solar installations, home solutions, and after-sale services.

⚡ Leading the EV Charging Revolution

Tata Power has emerged as a market leader in EV charging infrastructure. The company has created a nationwide network with:

- 5,500+ public & captive charging points

- 86,000+ home EV chargers

- 850+ bus charging stations

- 1,000 green energy-powered EV stations in Mumbai alone

As India accelerates EV adoption, Tata Power’s extensive EV network will play a crucial role in supporting the country’s electrification goals and urban mobility transformation.

🌍 Cross-Border & Strategic Alliances

In a significant international development, Tata Power has entered into a partnership with Bhutan’s Druk Green Power Corporation Ltd. (DGPC) to develop:

- 4.5 GW hydropower

- 500 MW solar capacity

This collaboration ensures sustainable, round-the-clock green energy supply to both Bhutan and India.

Tata Power also marked a milestone by supplying 50 MW of renewable energy to Bhutan, marking India’s first bilateral cross-border merchant energy trade.

💸 Capex and Investment Plans

Looking forward, Tata Power has announced ambitious capital expenditure plans:

- ₹25,000 crore capex planned for FY26

- The focus will be on expanding green energy, EV infrastructure, and distribution networks

- The company is also considering bids for two distribution companies (discoms) in Uttar Pradesh, further strengthening its hold in the utility sector

This shows that Tata Power is not just riding the current wave but actively creating new waves in India’s evolving power ecosystem.

📈 Market Response and Shareholder Confidence

Following the Q4 results, Tata Power shares gained attention on Dalal Street. Investors welcomed the positive earnings and strategic announcements, indicating high confidence in the company’s long-term vision.

The proposed dividend and consistent earnings performance make Tata Power an attractive stock for long-term investors looking for sustainable growth with regular returns.

🌱 Tata Power’s Role in India’s Energy Future

Tata Power is not merely a power company anymore — it’s becoming a green energy leader, tech-enabled utility, and mobility enabler for the future.

With its sharp focus on:

- Renewable expansion

- EV ecosystem development

- Smart city and green home solutions

- Strategic global partnerships

Tata Power is poised to play a pivotal role in India’s journey towards net zero by 2070.

✍ Final Thoughts: Should You Watch Tata Power?

Absolutely. Tata Power’s Q4 FY25 results are more than just a quarterly update — they reflect the company’s strategic clarity, operational discipline, and commitment to sustainability.

If you’re an investor, analyst, or a stakeholder in India’s energy future, Tata Power is a company that deserves your attention — both for its performance today and the promise of tomorrow.

Stay tuned for more business insights and energy sector updates. If you found this article valuable, don’t forget to share it on your social media or drop your thoughts in the comments below.

Also Read: –

NVIDIA Llama Nemotron: Unlocking the Next Generation of Reasoning AI

New Samsung Galaxy S25 Edge: A Powerful Flagship Packed with Impressive Features and Premium Design

Pingback: Housefull 5 Movie Review: Business, Budget, & Public Reactions - India PrimeTime

Pingback: RBI Repo Rate Cut 2025 : Full Impact on Home Loans, Banks - India PrimeTime

https://t.me/s/Top_BestCasino/135