BCCL IPO 2026: Complete Guide on Bharat Coking Coal Limited IPO – Dates, Price, GMP, Pros & Cons

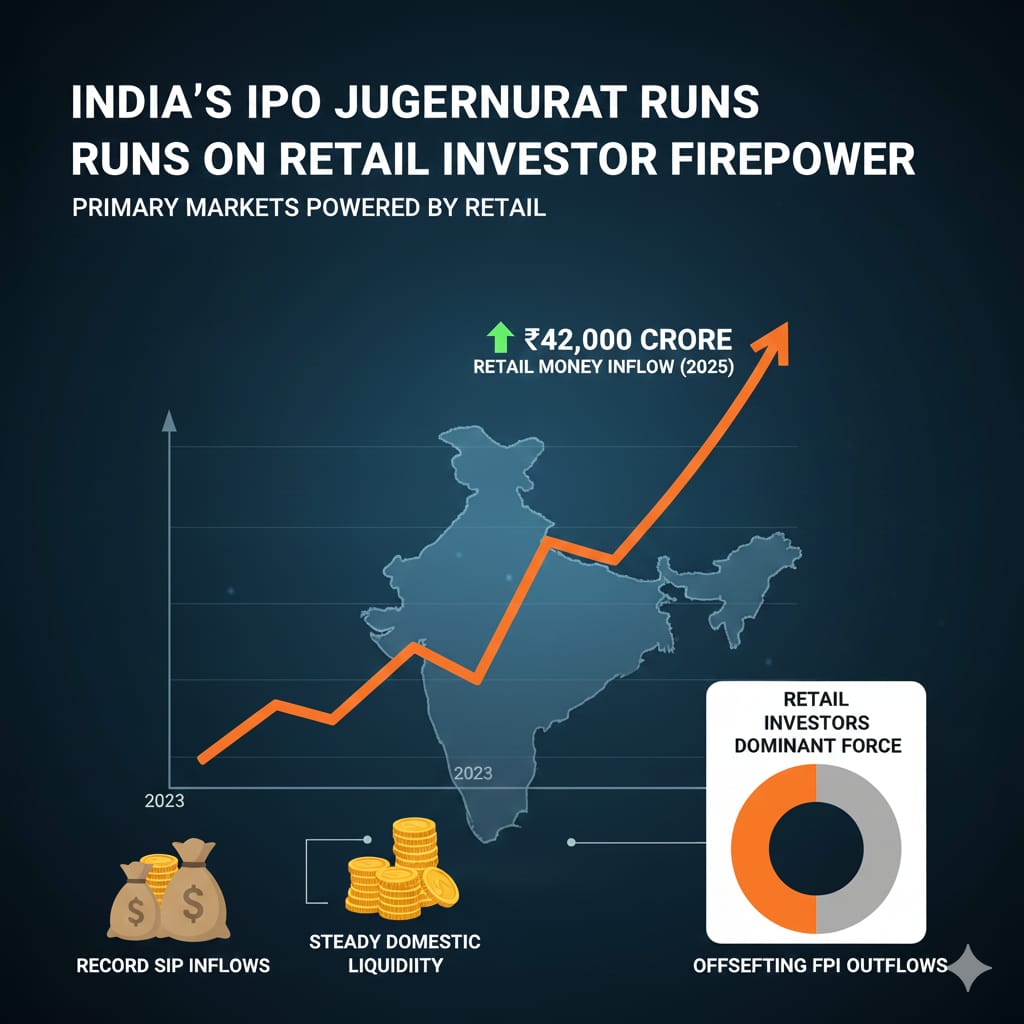

The Indian stock market is witnessing strong interest in PSU listings, and one of the most talked-about upcoming public issues is the BCCL IPO. Bharat Coking Coal Limited, a key subsidiary of Coal India Limited, is preparing to enter the capital markets, attracting attention from retail investors, HNIs, and institutional buyers alike.

In this detailed blog, we will cover everything you need to know about the BCCL IPO, including company overview, IPO details, price band, GMP, financial performance, strengths, risks, and whether you should consider investing.

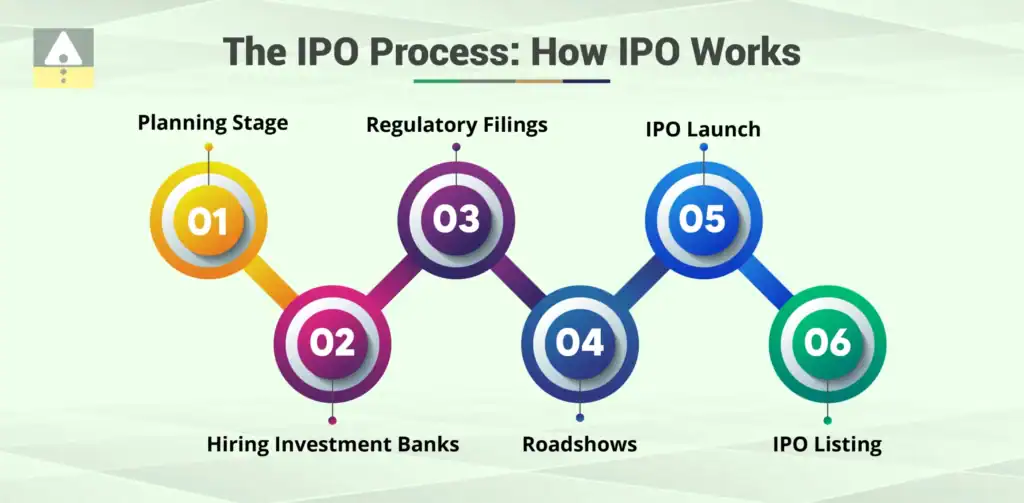

What is BCCL IPO?

The BCCL IPO refers to the Initial Public Offering of Bharat Coking Coal Limited, where a portion of the company’s equity will be offered to the public. This IPO is primarily an Offer for Sale (OFS) by Coal India Limited, meaning the company itself will not raise fresh capital, but the government will unlock value from its PSU asset.

BCCL is India’s largest producer of coking coal, a critical raw material used in steel manufacturing. With India’s infrastructure and steel demand continuously rising, BCCL plays a strategic role in the country’s industrial ecosystem.

About Bharat Coking Coal Limited (BCCL)

Bharat Coking Coal Limited operates primarily in the mineral-rich state of Jharkhand, which is known for having some of the finest coking coal reserves in India. The company manages a large number of underground and open-cast mines spread across major coalfields such as Jharia, Bokaro, and Giridih. These regions are strategically important because they produce prime coking coal, a critical raw material required for steel manufacturing. Due to the limited availability of high-quality coking coal in India, BCCL plays a crucial role in supporting the domestic steel industry and reducing dependence on expensive imports.

BCCL supplies coal to leading public and private sector steel plants across the country, ensuring a steady and reliable fuel supply for blast furnaces. Its operations are supported by an extensive network of coal washeries, transportation infrastructure, and long-term supply agreements, which help maintain consistency in both quality and volume. The company also focuses on coal beneficiation to improve coal quality and meet the specific requirements of steel manufacturers.

As a wholly owned subsidiary of Coal India Limited, BCCL benefits from strong government backing, financial stability, and policy-level support. This parentage provides access to modern mining technology, skilled manpower, and centralized planning. With decades of operational experience, BCCL has developed deep expertise in managing complex mining conditions, safety challenges, and large-scale production targets. Its long operational history, combined with strategic importance to India’s industrial growth, makes BCCL a key pillar in the country’s coal and steel ecosystem.

Key Business Highlights of BCCL IPO 2026

- Largest producer of coking coal in India

- Supplies coal to major PSU and private steel manufacturers

- Strategic importance in reducing India’s dependence on imported coking coal

- Strong parentage of Coal India Limited

BCCL IPO Key Details (Expected)

Although final details will be confirmed through the Red Herring Prospectus (RHP), market reports indicate the following structure:

| IPO Detail | Information |

|---|---|

| IPO Type | Offer for Sale (OFS) |

| Issue Size | Approx ₹1,000–1,300 crore |

| Price Band | ₹21 – ₹23 per share (expected) |

| Listing Exchanges | BSE, NSE |

| Retail Quota | Around 35% |

| QIB Quota | Around 50% |

| HNI/NII Quota | Around 15% |

BCCL IPO Dates (Tentative)

- IPO Opening Date: January 2026

- IPO Closing Date: January 2026

- Allotment Date: Within 3–4 days after closing

- Listing Date: Expected within a week of allotment

Note: Dates may change as per SEBI and market conditions.

BCCL IPO Grey Market Premium (GMP)

The BCCL IPO GMP has been strong in the unofficial market, indicating positive investor sentiment. High GMP generally reflects expectations of listing gains, though it is not guaranteed and should not be the sole basis for investment decisions.

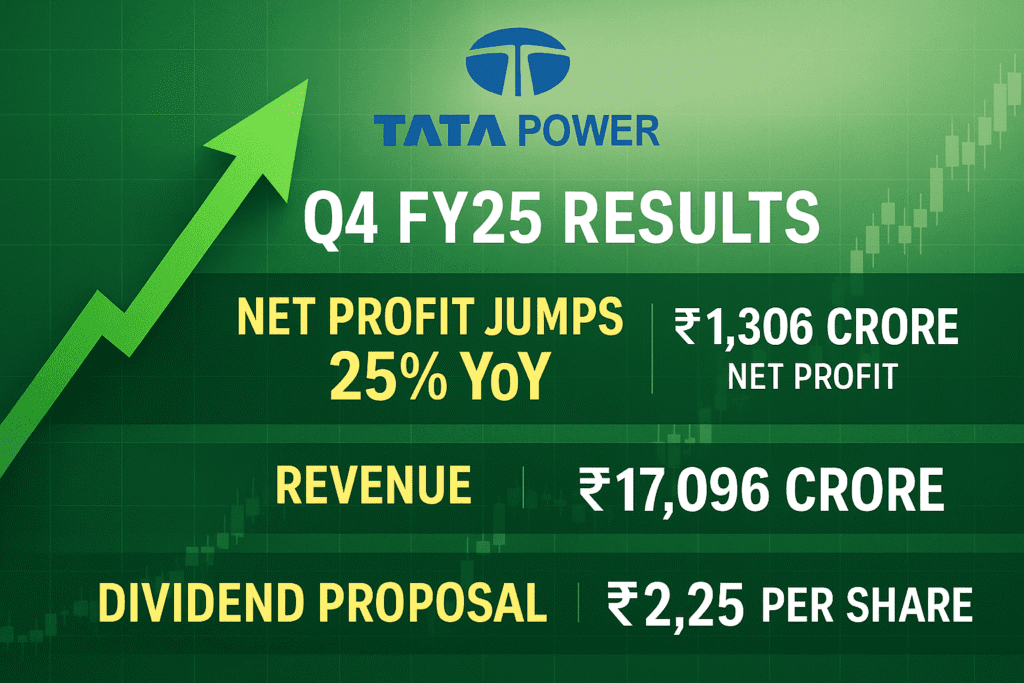

Financial Performance Overview

BCCL has shown stable revenue performance due to consistent demand from the steel sector. Being a PSU, margins are influenced by government pricing policies, operational costs, and coal production targets.

Key Financial Indicators

- Stable revenue backed by long-term supply contracts

- Strong asset base and mining reserves

- Backing of Coal India improves financial stability

Why BCCL IPO is Attracting Investors

- Strategic Sector Exposure

Coking coal is essential for steel manufacturing, making BCCL a critical player in India’s growth story. - PSU Trust Factor

Government-backed companies are often considered relatively safer for long-term investors. - Strong Parent Company

Coal India’s operational expertise and financial strength add confidence. - Import Substitution Theme

India aims to reduce dependence on imported coking coal, which benefits BCCL.

Risks & Challenges to Consider

Every investment carries risks, and the BCCL IPO is no exception.

- Heavy dependence on government policies

- Environmental and regulatory challenges

- Coal sector faces long-term transition risks due to renewable energy push

- Pricing control may limit profit expansion

Investors should carefully evaluate these factors before applying.

Should You Invest in BCCL IPO?

The BCCL IPO may be suitable for:

- Long-term investors looking for PSU exposure

- Investors bullish on India’s steel and infrastructure growth

- Those seeking relatively stable, government-backed businesses

Short-term listing gains are possible based on GMP, but long-term returns will depend on coal demand, policy support, and operational efficiency.

How to Apply for BCCL IPO

You can apply for the IPO through multiple convenient and secure methods available in India. Today, most investors prefer online application modes because they are fast, paperless, and easy to track.

The most common method is through your stockbroker’s trading app. If you already have a Demat and trading account, simply log in to your broker’s app, go to the IPO section, select the IPO you want to apply for, enter the number of lots, choose the cut-off price (for retail investors), and submit the application. The amount will be blocked in your bank account through ASBA until allotment.

Another trusted method is net banking using ASBA (Application Supported by Blocked Amount). Many major banks provide ASBA facility through their net banking portals. You just need to log in, select the IPO, fill in your Demat details, bid amount, and submit. The bid amount remains blocked and is debited only if shares are allotted.

You can also apply using popular online investment platforms like Zerodha, Groww, and Upstox. These platforms offer a very simple IPO interface, making them ideal for beginners.

Before applying, ensure your PAN, Demat account, and bank account are correctly linked, as any mismatch can lead to rejection of your IPO application.

Ensure your Demat account, PAN, and bank account are linked correctly before applying.

Final Verdict

The BCCL IPO 2026 stands out as one of the most important PSU IPOs in recent times. With strong fundamentals, strategic importance, and backing from Coal India, it has the potential to attract significant investor interest. However, as with any IPO, a balanced approach considering both opportunities and risks is essential.

Disclaimer

This article is for educational and informational purposes only. It is not investment advice. Stock market investments are subject to market risks. Please consult your financial advisor before investing in any IPO.

Also Read: –

HDFC Bank FD Interest Rates 2025: नई Fixed Deposit Rates जारी, Senior Citizen को मिलेगा ज्यादा ब्याज

RBI Repo Rate Cut 2025 : Full Impact on Home Loans, Banks

Coal India Shares Jump 3.5% as Bharat Coking Coal ₹1,300 Crore IPO Buzz Boosts Market Best Sentiment